By Divya Vats

The Ministry of Corporate Affairs vide its circular dated 17th June, 2020 has introduced a new scheme namely “Scheme for relaxation of time for filing forms related to creation or modification of charges under the Companies Act, 2013” (‘Scheme’) which provides an exclusion of period during a disruption on account of the pandemic caused by the COVID-19 phase of as long as 7 months i.e. From 1st March, 2020 to 30th September, 2020 for registering and modifying charges without additional fees till 30th September, 2020.

The Scheme is applicable on creation and modification of charges i.e. for CHG-1 (other than those related to debentures) and CHG-9 (For debentures) by a company or charge holder.

Satisfaction of charge is not covered under the Scheme.

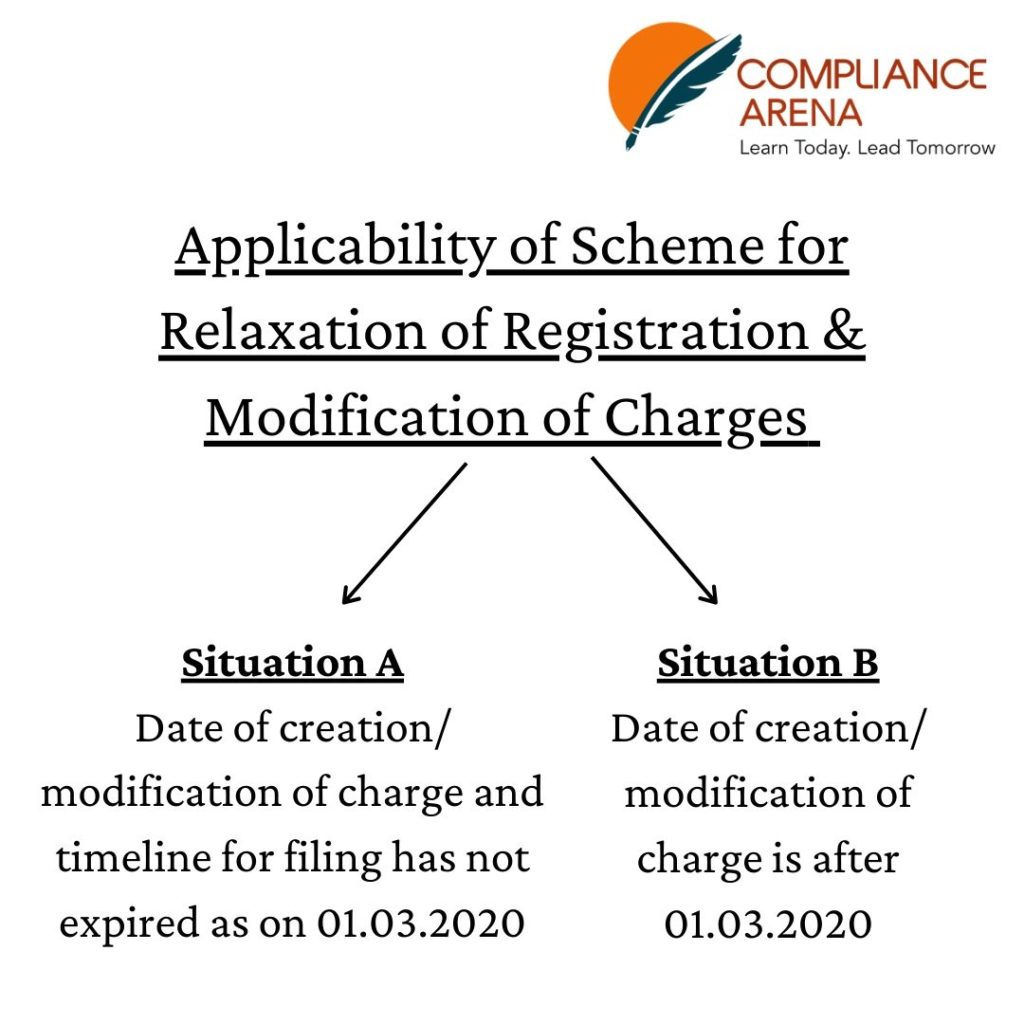

Applicability of the Scheme has been divided into two broad heads:

Relaxation of time:

- If form filled under situation A , then the period beginning from 01.03.2020 to 30.09.2020 shall not be counted for calculating the timeline under sec.77 or 78. In case form is not filed within that timeline, the first day after 29.02.2020 will be counted as 01.10.2020 for the purpose of timeline under respective sections of the Act.

- If form filled under situation B above the period beginning from the date of creation/ modification of charge to 30.09.2020 shall not be count for the purpose of calculation of days under section 77 or section 78 of the Act, if not filled then first day will be counted as 01.10.2020 for the same timeline.

Applicable fees:

- As per above (1), if form is filled before 30.09.2020 the same fee will charge as chargeable on 29.02.2020. in case If the form is filed thereafter, the applicable fees shall be charged after adding the number of days beginning from 01.10.2020 and ending on the date of filing plus the time period lapsed from the date of the creation of charge till 29.02.2020.

- As per above (2), if form filled before 30.09.2020 normal fee will be charged. in case If the form is filed thereafter, the first day count as 01.10.2020 and the number of days till the date of filing of the form shall be calculated accordingly for the purposes of fees.

The scheme shall not apply in these cases:

- Form CHG-1 and CHG-9 already filled before date of scheme.

- The timeline for filling these forms has already expired prior to 01.03.2020.

- For filling Form CHG-4 (Satisfaction of charges).

The circular provides a relaxation from the additional fees and the late penalties from the non-filing of charge related documents to ROC due to the covid pandemic.

For any queries or requirements contact

Divya Vats

Co-founder Compliance Arena

info@compliancearena.in

8447773833, 9205080043