By Simran Kaur

[Issue of securities in dematerialized form by unlisted public companies]

Dematerialization (Commonly known as ‘Demat’) signifies conversion of a share certificate from its present physical form to electronic form for the same number of holding.

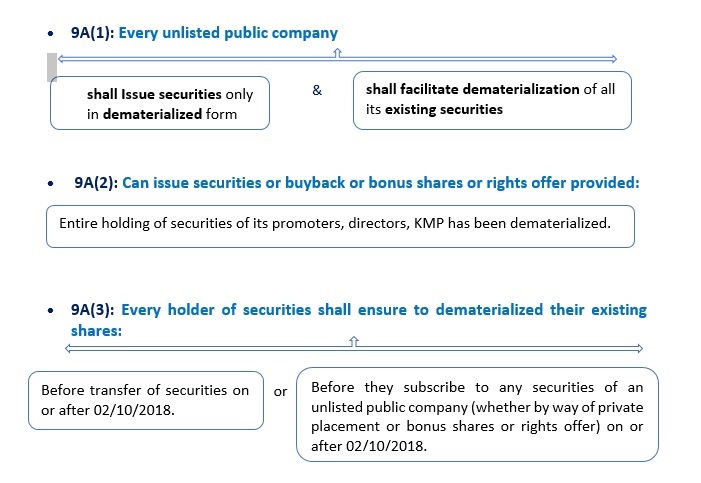

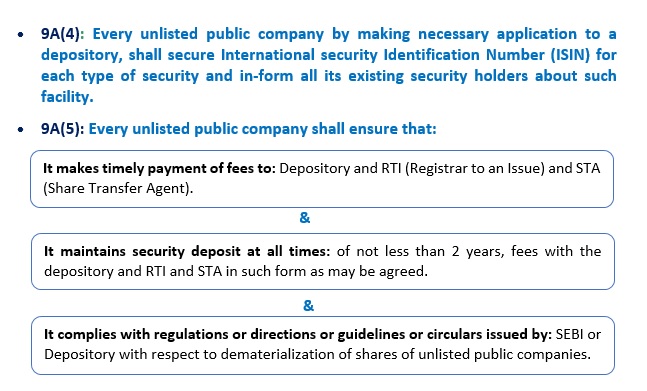

Beneath are the provisions applicable under companies Act 2013 with regard to the same:

- 9A(6): No unlisted public company which has defaulted in 9A(5): shall make offer of any securities or buyback or issue any bonus or right shares till the payments to depositories or RTI and STA are made.

- 9A(7): The provisions of the Depositories Act 1996 the SEBI (Depositories and participants) Regulations, 2018 and the SEBI (Registrars to an Issue and share Transfer Agents) Regulations, 1993 shall apply mutatis mutandis to dematerialization of securities of unlisted public companies.

- 9A(8): Every unlisted public company shall submit Form PAS-6 (see annexure 1) to the ROC within 60 days from the conclusion of each half year duly certified by a Company Secretary in practice or Chartered Accountant in practice.

- 9A(8A): The company shall immediately bring to the notice of the depositories any difference obsen’ed in its issued capital and the capital held in dematerialized form.

- 9A(9): The grievances of security holders shall be filed before the IEPF Authority.

- 9A(10): The IEPF Authority shall initiate any action against a depository or participant or RTI and STA after prior consultation with the SEBI.

- 9A (11): This rule shall not apply to an unlisted public company which is:

(a) a Nidhi;

(b) a Government company or

(c) a wholly owned subsidiary

PROCEDURE AND DOCUMENTS TO BE SUBMITTED WITH THE DEPOSITORY:

- Firstly open an account with a Depository Participant (DP) and get a unique Client ID number along with documents:

– Application for the Eligible Securities

– Net worth certificate from a Chartered Accountant.

– Certified true copy of Board Resolution mentioning name of signatories who are authorized by Board to execute documents and list of Authorized Signatories along with specimen signature.

– Confirmation letter from Registrar & Transfer Agent.

– COI, MOA and AOA.

– Certified true copy of Audited annual report for the last financial year.

– Certified true copy of PAS‐3 (If any).

– If there is any variation in capital then company has to provide certified true copy of SH‐7.

- Thereafter fill up a Dematerialization Request Form (DRF) provided by the DP and surrender the physical shares certificate.

- The DP upon receipt of the shares certificates and the DRF will send an electronic request to the company’s RTI and STA.

- The company’s registrar and share transfer agent after necessary verification of the documents received from the DP will confirm demat to the Depository.

- This confirmation will be passed on from the Depository to the DP, after receiving this confirmation from the Depository, the DP will credit the account with the shares so dematerialized.

- The DP will hold the shares in the dematerialized form thereafter on your behalf. And you will become beneficial owner of these dematerialized shares.

SOME FAQS:

Q: What Dematerialization is?

A: Dematerialization is the process by which physical Share certificates are converted into electronic form from the same number of holding.

Q: Applicability of Rule 9A on?

- Unlisted Public Companies, and

- Private company which is wholly own subsidiary of a public Company.

Q: What comprises Securities include as per SCRA 1956?

- shares, scrips, stocks, bonds, debentures, debenture stock or other marketable securities.

- Derivative

- units issued by any CIS (collective investment scheme)

- security receipt issued under SARFAESI 2002

- units issued under any MF (mutual fund) scheme

- Government securities

- such other instruments as may be declared by the CG

- rights or interest in securities

Q: Who is Depository under Depositories Act, 1996?

A: Depository means a company formed and registered under the Companies Act, 1956 and which has been granted a certificate of registration section 12 of the SEBI Act, 1992.

Q: Which are current Depositories in India?

- National Securities Depository Ltd (NSDL)

- Central Securities Depository Ltd (CDSL)

Q: Which provisions are applicable?

- Companies (Prospectus and Allotment of Securities) Rules, 2014

- Depositories Act 1996

- Securities Contracts (Regulation) Act, 1956

Q: Who is RTA?

A: RTA acts as an intermediary between the issuer and depository for providing services of dematerialization.

Q: Is Stamp Duty still required after Dematerialization?

A: Now there is no requirement to keep physical share certificates, therefore no stamp duty will be required to be paid at the time of further transfer.

Q: What is the time limit to get ISIN?

A: Usually it takes 20-25 days to get the ISIN.

For any Queries or Requirements contact

Team

Compliance Arena

info@compliancearena.in

8447773833