Striking off a Company

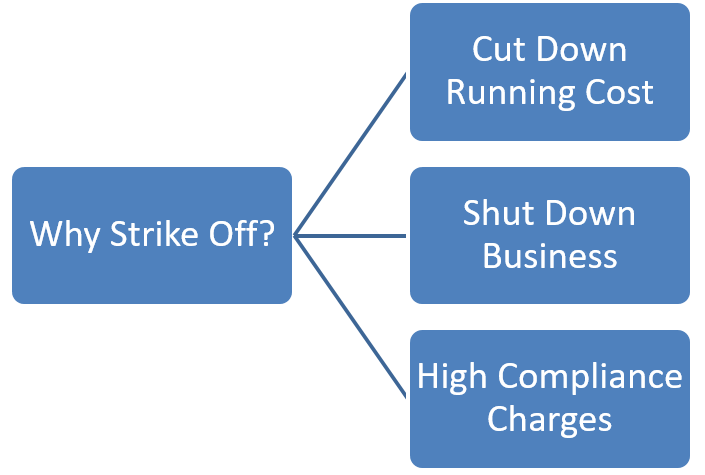

Striking off a Company plays a major role in the life of a company as it brings to the end of the working of the company and also brings a stress free atmosphere to the management.

Companies Act, 2013 regulates the striking of name of the company from the ROC and it is a voluntary winding up process in the hands of the company. Section 248 to Section 252 of the Companies Act, 2013 regulates the process of Strike Off.

Here, we will talk about the Application for Strike off a Company Suo-Moto:

10 Steps for Striking off a Company Suo Moto:-

1. Holding a Board Meeting.

2. Extinguishment of all Liabilities.

3. Holding a GM and pass Special Resolution or take approval of 75% of members as per paid up share capital.

4. File MGT-14 within 30 days

5. NOC from regulatory authorities ,if any.

6. Application to ROC in e-form STK-2 with fees of Rs.10,000/-

7. Attach necessary documents with STK-2

· Indemnity Bond in Form STK-3.

· Affidavit in Form STK-4.

· Statement of Accounts in Form STK-8 regarding assets and liabilities made up to 30 days before date of application certified by PCA.

· Copy of SR passed in point 3.

· Statement of Pending Litigation, if any.

8. Public Notice in Form STK-6 be placed on the website of MCA and Published in the Official Gazette and Published in 2 Newspaper, and Company website if any.

9. After completion of time period mentioned in notice and after all approval ROC will initiate the Striking off Process.

10. ROC shall strike off the name of the company and publish in Official Gazette notice in Form STK-7.

Strike off Process normally takes 2- 3 Months and any discrepancies in the process will lead to increase in the time frame.

Companies Act, 2013 has made the Striking off process simple, easy and cost effective.

For any Queries contact:

8447773833

Well detailed explanation

Thanks for the appreciation ☺️

Whether Bank Account needs to be closed before initiating striking off process??

Yes, Bank Account should be closed before initiating the Striking off Process.

nicely made. some more steps also to be done like

closure of bank accounts, clearing of debtors, creditors and also what to do about the assets if any or paid up capital – can it be mentioned on this also. balance sheet status how it should be. thanks