So today we will discuss one of the most technical provision in Companies Act, 2013 which is Section 185 which talks about Loan to Directors. Section 185 was substituted by Companies (Amendment) Act, 2017 w.e.f. 07th May, 2018. The amendment has overcame the loopholes of the old provision and has made the new section crystal clear.

So let’s start with the analysis:

For this section Loans means Loan including any loan represented by a book debt to, or guarantee or any security in connection with any loan.

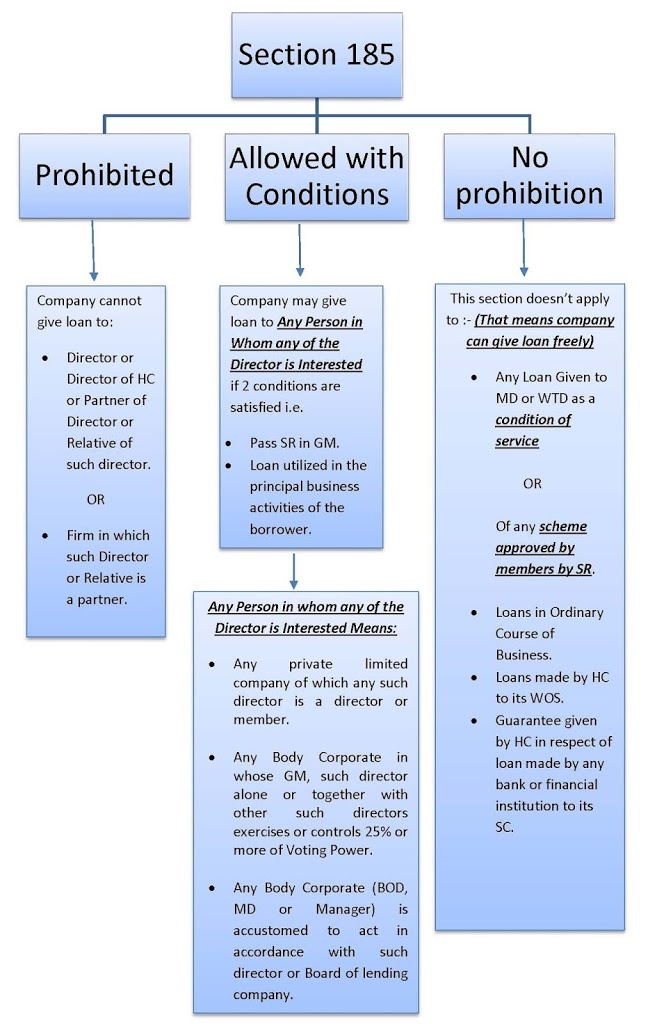

So, we can divide the section into 3 parts which are Prohibited Loans, Loans which are allowed with conditionsand Loans on which this section does not apply i.e. Non-prohibited Loans.

Penalty for Contravention:-

· Penalty to Company- Rs. 5 Lakh to Rs. 25 Lakh.

· Officer in Default/ Director or Other Person Involved –

(i) Imprisonment- Max 6 Months

Or

(ii) Fine- Rs. 5 Lakh to Rs. 25 Lakh.

For Ready Reference:-MCA e-book

In case of Private Companies, section 185 shall not apply if certain conditions are fulfilled.

Can private company give loan to director?

Yes, if all the conditions are fulfilled then company can give loan to directors.