Government on 8th June, 2020 have rolled out a scheme wherein the Govt. allows the eligible taxpayers to file their Nil Monthly Return in Form GSTR-3B through SMS.

This move will definitely help the taxpayers in filing their return timely and also facilitate the ease of compliance.

Eligible taxpayers who can file NIL FORM GSTR-3B though SMS?

- Taxpayers must be registered as Normal taxpayers/ Casual Taxpayer/SEZ Unit/ SEZ Developer and must have valid GSTIN.

- Authorised Signatory mobile number must be registered on the portal.

- No pending liability or interest for previous period.

- Previous GSTR-3B must be filed.

- No data should be in saved stage in the online portal.

Note:- Any Authorized Representative for a GSTIN is allowed to file NIL return through SMS. However, registered mobile number should not be common with other authorized representative for the same GSTIN.

Who can file Nil Form GSTR-3B?

Nil Form GSTR-3B for a tax period can be filed, if you:

- Have NOT made any Outward Supply and

- Do NOT have any reverse charge liability

- Do NOT intend to take any Input tax credit and

- Do NOT have any Liability for that particular or earlier Tax Periods.

How do I get help on Nil Form GSTR-3B filing through SMS?

You need to send SMS in below format to get help related to filing Nil Form GSTR-3B through SMS.

SMS Format: HELP space<Return Type>

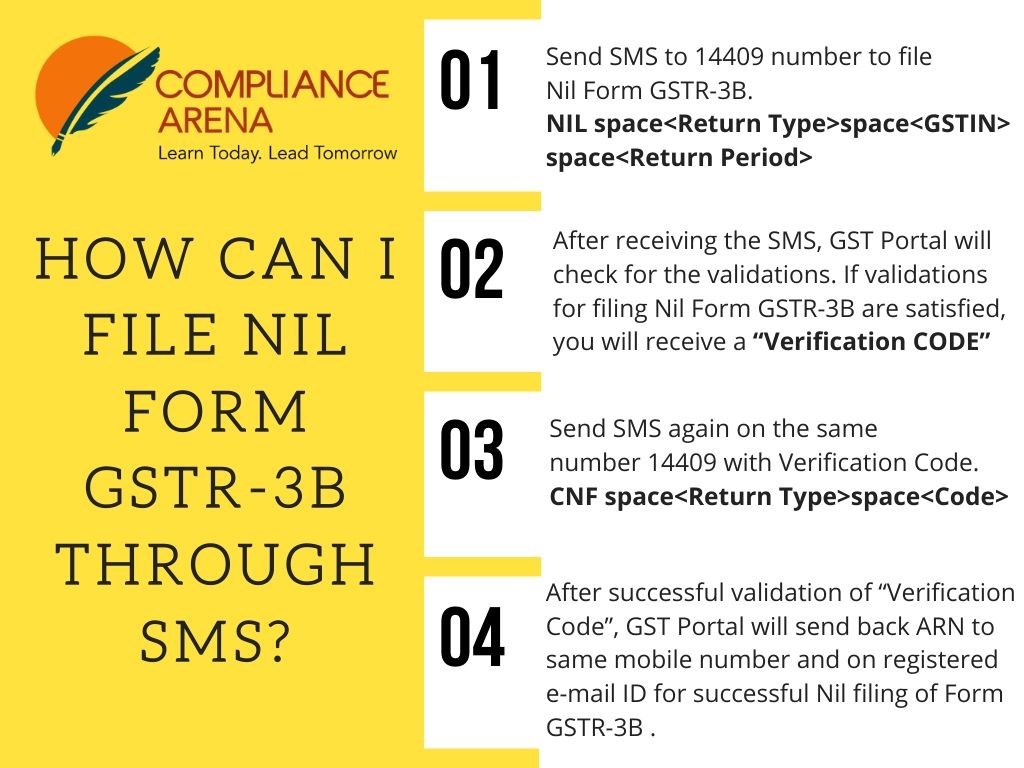

How can I file Nil Form GSTR-3B through SMS?

| S.No. | Step-List | SMS Format | Example |

| 1 | Send SMS to 14409 number to file Nil Form GSTR-3B. | NIL space<Return Type>space<GSTIN> space<Return Period> | NIL 3B 07PGTP P8277H8Z6 022019 |

| 2 | After receiving the SMS, GST Portal will check for the validations. Note: If validations for filing Nil Form GSTR-3B are satisfied, you will receive a “Verification CODE” on the same mobile number to complete the filing. If validations for Nil filing are not satisfied, you will receive appropriate response/ error message to the same mobile number Note: Verification Code is usable only once and will expire within 30 minutes. | ||

| 3 | Send SMS again on the same number 14409 with Verification Code (For Example: Verification Code received here is 185343) to confirm filing of Nil Form GSTR-3B. Note: Taxpayers are required to compose a new text message to 14409. | CNF space<Return Type>space<Code> | CNF 3B 185343 |

| 4 | After successful validation of “Verification Code”, GST Portal will send back ARN to same mobile number and on registered e-mail ID of the taxpayer to intimate successful Nil filing of Form GSTR-3B . |

What will happen after successful filing of Nil Form GSTR-3B, through SMS?

After successful filing of Nil Form GSTR-3B, through SMS:

- ARN will get generated.

- The status of Form GSTR-3B is changed to Filed on GST Portal.

- An SMS and e-mail will be sent to the e-mail and mobile number of the primary authorized signatory.

- In case, sender is authorized signatory, SMS will be sent to his/her mobile number also.

Filing of GST Return through SMS brings a lot more of practicality in the Covid times to file the returns on time.

For more queries or requirements contact

CS Arpit Garg

Founder- Compliance Arena & Practicing Company Secretary

info@compliancearena.in

8447773833