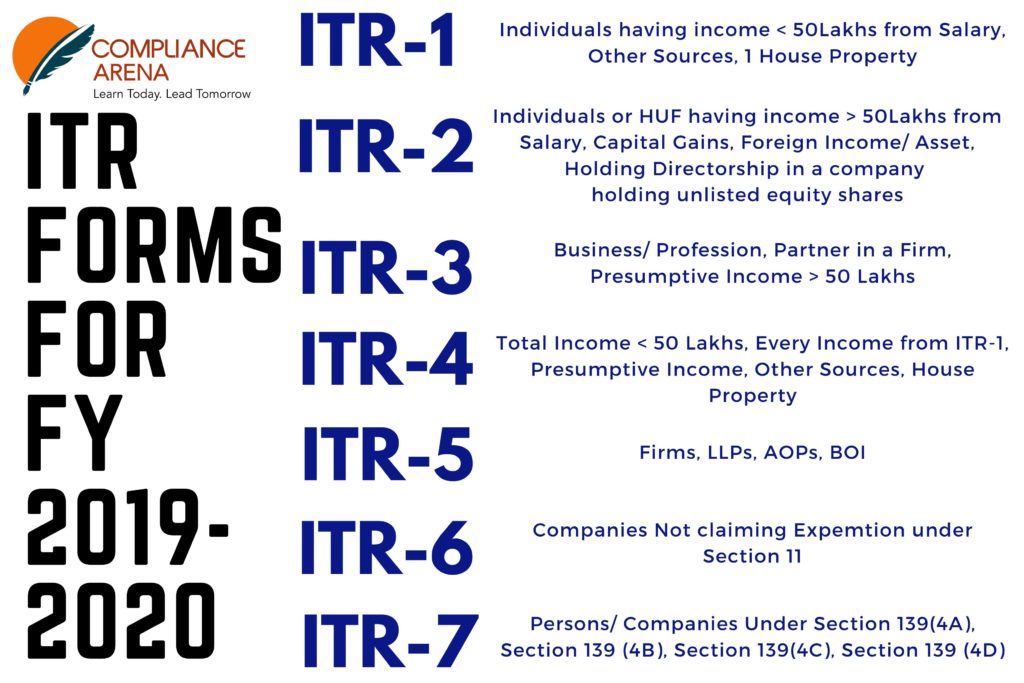

Central Board of Direct Taxes have notified the ITR forms for FY 2019-2020 (AY 2020-2021) on 29th May, 2020. The ITR filing deadline has also been extended from July 31 to November 30.

What is ITR?

Income Tax Return (ITR) is a form in which every taxpayer file information about his income earned and tax on the income. CBDT have notified 7 forms ITR-1, ITR-2, ITR-3, ITR-4, ITR-5, ITR-6, ITR-7 in which every person should file their income tax return accordingly.

Which ITR should I file for FY 2019-2020?

ITR-1 and ITR-4 is available for Filing for FY 2019-2020 on income tax portal for filing purpose. We are providing a detailed information about the ITR-1 form (Sahaj) & ITR-4 (Sugam)

ITR-1 (Sahaj)

This Return Form is for a resident individual whose total income for the assessment year 2020-2021 upto Rs. 50 lakh

- Income from Salary/ Pension or

- Income from One House Property (excluding cases where loss is brought forward from previous years); or

- Income from Other Sources (excluding Winning from Lottery and Income from Race Horses)

- Agricultural income up to Rs.5000.

Who cannot use ITR 1 Form for filing ITR?

- If Total income exceeds Rs 50 lakh

- Agricultural income exceeds Rs 5000

- If there is taxable capital gains

- If you are a Director in a company

- If you have had investments in unlisted equity shares at any time during the financial year

- If you have income from business or profession

- Income from more than one house property

- If you are a resident not ordinarily resident (RNOR) and non-resident

- Having foreign assets or foreign income

ITR-4 (Sugam)

The current ITR 4 is applicable to individuals and HUFs, Partnership firms (other than LLPs) which are residents having income from a business or profession. It also include those who have opted for the presumptive income scheme as per Section 44AD, Section 44ADA and Section 44AE of the Income Tax Act.

Who cannot use ITR 4 Form for filing ITR?

- If your total income exceeds Rs 50 lakh

- Having income from more than one house property

- If you have any brought forward loss or loss to be carried forward under any head of income

- Being a resident not ordinarily resident (RNOR) and non-resident

- Having foreign assets or foreign income

- If you are assessable in respect of income of another person in respect of which tax is deducted in the hands of the other person.

- Owning any foreign asset

- If you have signing authority in any account located outside India

- Having income from any source outside India

- If you are a Director in a company

- If you have had investments in unlisted equity shares at any time during the financial year

Due date of all income-tax return for FY 2019-20 will be extended from 31st July 2020 & 31st October 2020 to 30th November 2020 and Tax audit from 30th September 2020 to 31st October 2020.

For any further information or requirements contact

CS Arpit Garg

Founder- Compliance Arena

info@compliancearena.in

8447773833

I am working in a company as consultant. They are deducting TDS under 154J, I am company secretary giving services to company… Can you plz guide which ITR should I file to get tds refund?

Hello, You can file ITR-3 or ITR-4 as per your other conditions. You can take TDS refund on any forms prescribed by CBDT.