by Luv Wadhwa

Any Company (whether Private Limited or Public Limited) has to comply with various event based compliances which are other than the usual and mandatory annual and periodical compliances made by the organization with ROC and other administrative authorities. At times Companies miss the deadlines of such event based compliances either due to unawareness or due to complex legal provisions and which leads to fine, penalties to the Company as well as its officers.

The provisions related to Charges (Registration, Modification and Satisfaction) are one of those event based compliance.

Under the provisions of the Companies Act, 2013 Charge is defined as an interest or lien created on the assets or property of a Company or any of its undertaking as security and includes a mortgage U/s 2(16). Section 77 of the Companies act 2013 regulates the provision for Creation, registration and duties to register charges with Registrar of Companies within prescribed period.

However, Companies (Amendment) Ordinance, 2018 have bought certain changes in the timelines for Creation/Modification of charges with a view to create stricter time norms than before. The complex provision of the Section 77 is creating some practical difficulties to Companies while filing forms related to registration of creation of charge. Find Below the attempt to decode the same:

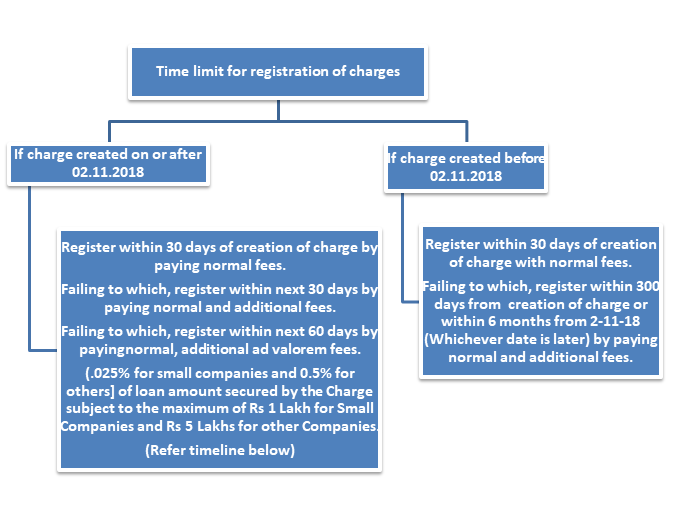

The amendment divides the provision into 2 parts:

- If charge created on or after Date of ordinance (i.e. 2-11-2018)

- If charge created before Date of ordinance (i.e. 2-11-2018)

If charge created on or after date of ordinance (i.e. 2-11-2018):

Company has the responsibility to file E-form CHG-1/9 for the registration of the Charge with ROC within 30 days of creation by paying normal fees.

If Company fails to file within first 30 days then Charge can be registered within a period of 60 days of such creation by Company as well as Charge holder by paying normal fees with additional fees.

If Company fails to file within 60 days ROC may, on an application made, allow such registration to be made within a further period of 60 days by paying normal fees, additional fees and ad valorem fees

If charge created before date of ordinance (i.e. 2-11-2018):

Company shall file E-form CHG-1/9 for registration of charge within 30 days of creation.

In case the company fails to file the same within 30 days of creation, in that case Registrar may, on an application by the company, allow such registration to be made within a period of 300 days of such creation OR within 6 months from the date of commencement of the Companies (Amendment) Ordinance, 2018, i.e. by 01st May, 2019 WHICHEVER IS LATER, on payment of such additional fees as may be prescribed.

Advalorem fees chart:

| Category | Fees |

| Small Companies | 0.025% of loan amount secured by charge subject to maximum limit of Rs. 1 Lakh |

| Any other Companies | 0.5% of loan amount secured by charge subject to maximum limit of Rs. 5 Lakh |

The pictorial representation for above provision is given for reference:

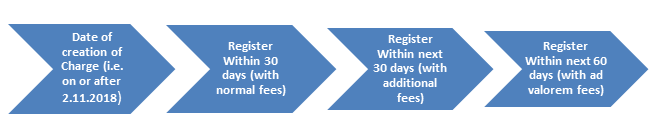

Timeline for registration of charges by the company (created on or after 02-11-2018) :

Other important points:

- If the company fails to register the Charge, and the charge holder applies to ROC for registration of the same, then the charge-holder shall be entitled to recover from the company the amount of any fees or additional fees or advalorem fees paid by him to the Registrar to create/ modify the charge.

- After the Companies Amendment Ordinance, 2018 become effective, as per Rule 12, Condonation of delay by Central Government is not allowed for delay in creation or modification of charge. However, Central Government may condone delay of filing of satisfaction of charge, if such filing is not made within a period of 300 days from the date of such payment or satisfaction.

- In case of contravention by Company: Minimum fine of Rs. 1 Lakh and Maximum fine of Rs. 10 Lakh.

- Contravention by officer of Company: Imprisonment upto 6 months OR minimum fine of Rs. 25,000 and maximum fine of Rs. 1 Lakh.

Liability under section 447 can also be attracted if any person willfully furnishes wrong information or knowingly suppresses any material information required U/s 77.

- Forms:

E-form CHG-1- Application for registration of creation of charge (other than debenture)

E-form CHG-2- Certificate for registration of charge

E-form CHG-9- Application for registration of charge for debenture

E-form CHG-8- Application to Central Government for extension of time for filing particulars of registration of creation of charge.

Registration of Charges are the most important and an essential compliance as non-compliance of the same will fetch heavy penal provisions.

For any Queries or Requirements

Team

Compliance Arena

info@compliancearena.in

8447773833