by Raghav Goyal

India is a country where people are more inclined towards business rather than job as their livelihood.Running a business by incorporating a company is most popular these days.Everyone wants to run their business smoothly however many times mishaps happen and there are chances when no activity is performed in business for time being.Companies Act,2013 gives power to Registrar of Company under Section 248 to strike off the name of company if there no operation during 2 years unless it has obtained status of a Dormant Company under Section 455.

In this article we will discuss how we can obtain the status of Dormant Company and what will be the post- compliances after that.

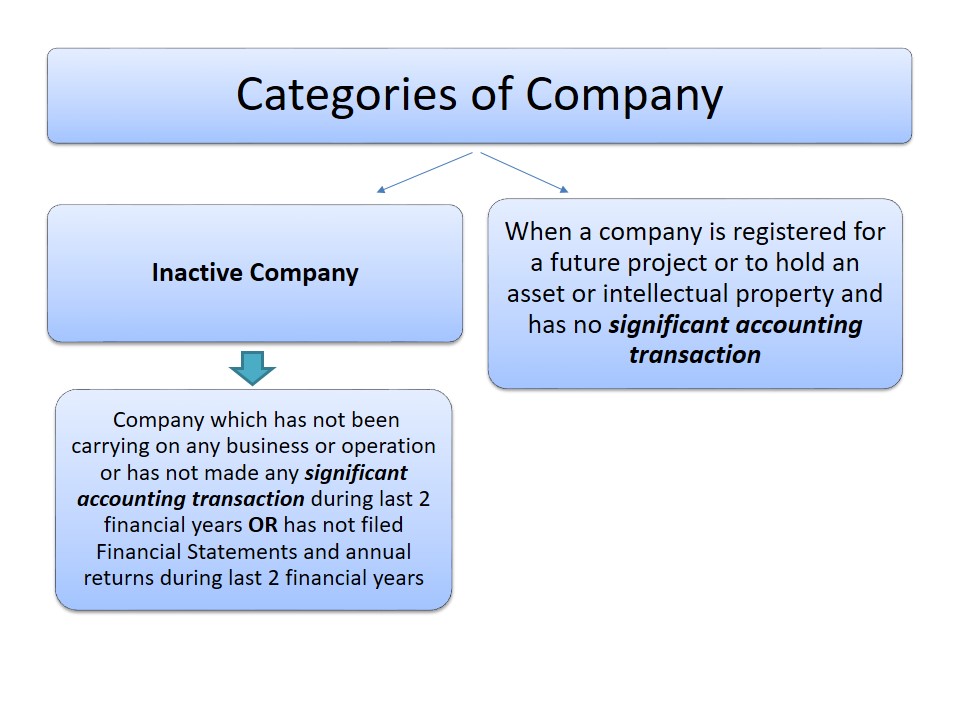

Categories of Dormant Company:-

Definition of Significant Accounting Transaction is given under Explanation to Section 455

Significant Accounting Transaction means any transaction other than:-

- Payment of fees to registrar

- Payment made to fulfill the requirements of act/law

- Allotment of shares to fulfill requirements of act

- Payments for maintaining office and records

Benefits of Obtaining status of Dormant Company:-

- Lower statutory compliances cost

- Protection of Company Name

- Reduced probability of penalty & legal proceedings

- Efficiency of time & money

- Not indulge in incorporation process again

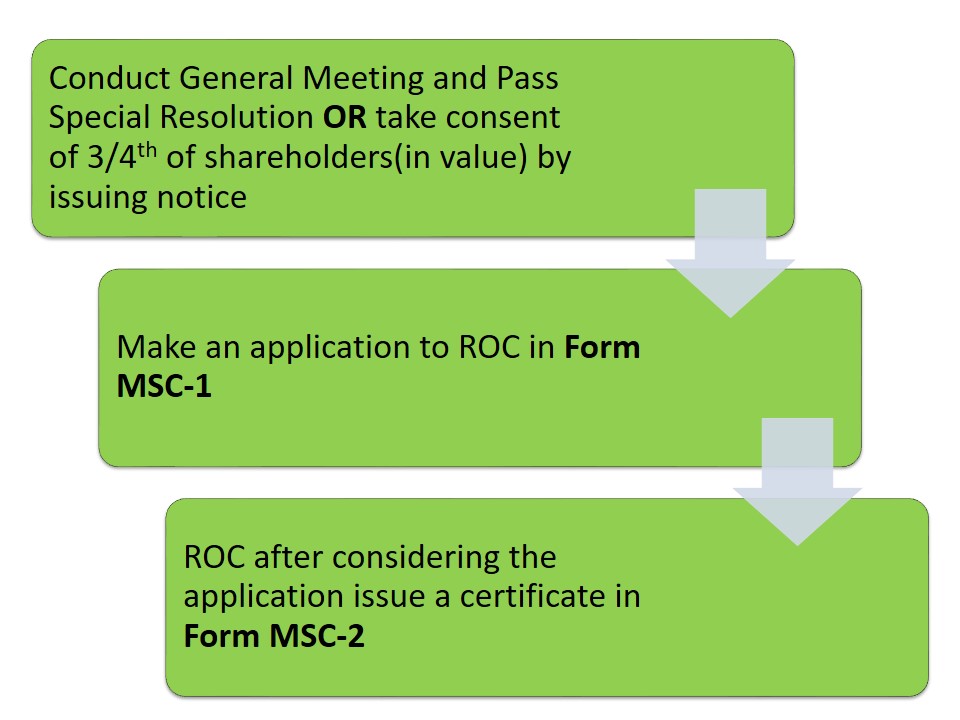

How to Obtain Status of Dormant Company:-

Pre-condition for obtaining Status of Dormant Company:-

- No inspection,inquiry or investigation is initiated

- No prosecution has been initiated

- There is no outstanding deposit or any default in payment or interest thereon

- No outstanding loan, if any, consent obtained from lender

- No dispute in management

- There is no outstanding taxes/dues etc. payable to government

- No default in payment of workmen’dues

- Securities are not listed in India or outside India

Compliances of Dormant Company:-

- Conduct atleast 1 Board meeting in each half of calendar year and minimum gap should be 90 days

- No requirement of Cash Flow in Financial Statement

- Dormant Company should have a minimum of 3 Directors, 2 Directors or 1 Director in case of Public, Private and One Person Company respectively.

- File Return of Dormant Company in Form MSC-3 within 30 days of end of Financial year duly audited by a CA in practice.

Dormant Company is the best way to retain the status of your company and reduce the overall compliance cost of the company.

In case of any queries or requirements contact

Team

Compliance Arena

info@compliancearena.in

8447773833