by CS Arpit Garg

Registered Valuer (RV) have become the keen person in the modern era for valuation of securities, properties, financial assets etc.

Valuation by Registered Valuers are been governed under Section 247 of Companies Act, 2013 wherein any valuation to be conducted under Companies Act, 2013 and any other provision shall be done only by Registered Valuers.

Here, we will discuss what the section says and how to become a Registered Valuer. Later on we will publish what all areas do Registered Valuers have in the industry to practice.

Valuation done in respect of :-

- Property

- Stock, Shares, Securities

- Debenture

- Goodwill

- Assets or Liabilties

- Net Worth of Company

Shall be done by a Registered Valuer appointed by Audit Committee or Board of Directors of the Company (in absence of earlier one)

Prohibition on taking valuation assignments:- If RV has a direct or indirect interest or becomes so interested at any time during a period of 3 years prior to his appointment as valuer or 3 years after the valuation of assets was conducted by him, then RV cannot take valuation of asset assignment.

Penalty for Contravention of Provisions by Valuer

The valuer shall be punishable with fine of Rs. 25,000/- minimum but which may extend to Rs. 1 Lakh Rupees.

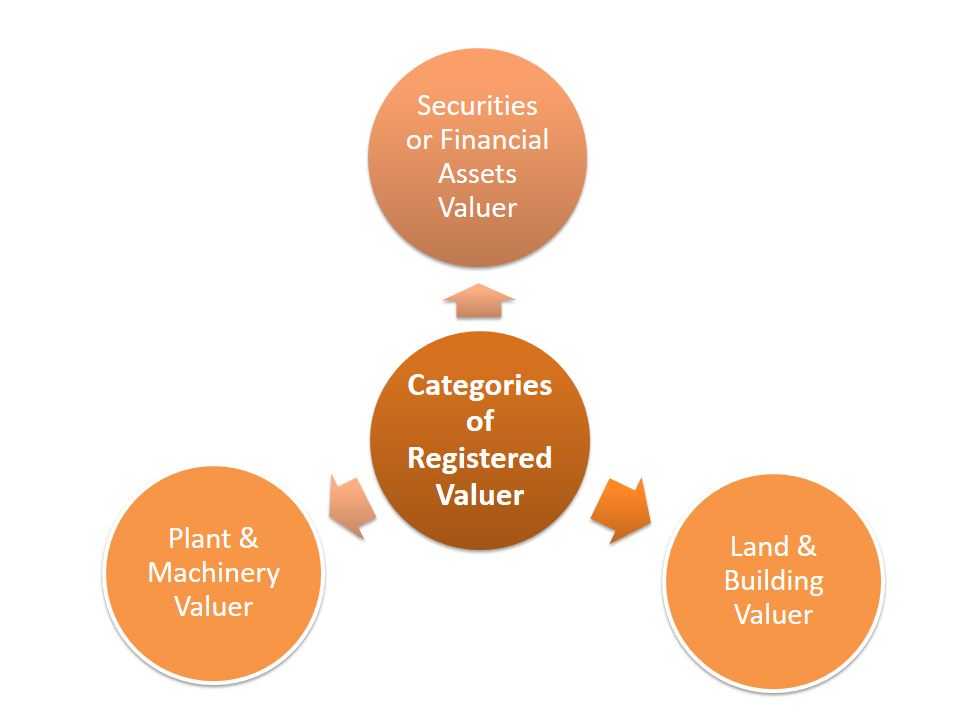

Categories of Registered Valuer on the basis of Asset Class

For Valuation under Companies Act, 2013, a person need to become the Securities or Financial Assets Valuer as provided by IBBI.

How to Become Registered Valuer?

Step 1: As per rule 4 read with Annexure-IV of the Companies (Registered Valuers and Valuation) Rules, 2017, an individual shall have the following qualifications and experience to be eligible for registration as Registered Valuer:

- Graduate + 5 years post qualification experience, or

- Post Graduate + 3 years post qualification experience, or

- Membership of a professional institute (ICSI, ICAI, ICMAI) + 3 years post qualification experience.

Note:- For Securities or Financial Assets Class only 2 categories are there w.r.t Membership of a Professional institute or Post Graduate. (both having 3 years of experience.)

Step 2: Enroll with the Registered Valuers Organisation (RVO) for Valuation of Securities or Financial Assets Class. There are many like ICSI RVO, ICAI RVO, ICMAI RVO and many more.

Step 3: Completion of educational course conducted by the respective RVO’s.

Step 4: Clearing the Valuation Examination conducted by IBBI

Step 5: Registration with IBBI and respective RVO will issue the certificate of practice to the RV.

Registered Valuers are the key professionals in the industry to play a keen role for the valuation of assets and provide a true and fair valuation report in the industry.

We will publish a another article wherein we will provide the areas in Companies Act, 2013 for the RV to practice. So till then stay in touch and stay connected.

In Case of any queries or requirements contact

CS Arpit Garg

Founder- Compliance Arena

info@compliancearena

8447773833

One Reply to “Registered Valuer”