Small Company – A Magical Way to Start Your Business

Everybody in this changing business scenario wants to register their start up as Private Limited Company. Getting registered as Private Limited Company gives Start-up a Big Advantage over other businesses and gives start up a way to get their working streamlined.

Today, we are going to talk about Small Company. Small Company is a concept introduced by Companies Act, 2013 which gives ample number of exemptions from Compliance Management and allows the Management to focus more on the business workings rather than Legal things in the early stages of their Life.

So Let’s Start with Definition of Small Company?

Small Company means a PRIVATE COMPANY having

Paid Up Share Capital of Less than or Equal to Rs. 50 Lakh

AND

Turnover of Preceding Financial Year of less than or equal to Rs. 2 Crore.

So any Company which falls under both of the Criteria will automatically become the SMALL COMPANY. However, Holding Company or Subsidiary Company, Section 8 Company or any Company governed any special act have been kept outside the ambit of Small Companies.

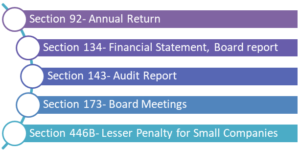

1. Section 92- Form MGT-7 can be signed by Company Secretary or by Director of the Company.

2. Section 134- Small Company shall have Abridged Board Report for the compliance of the section. Also, Financial Statements of Small Company may not include CASH FLOW STATEMENTS.

3. Section 143- For Audit Report of Small Companies, statement in relation to internal financial controls with reference to financial statements is not required.

4. Section 173- For Small Companies, 4 Board Meetings are not required. Only 2 Board Meetingin each half of a Calendar year i.e. every 6 months will do the same. Also Minimum Gap between two BM should be 90 or more days.

5. Section 446B- Non-Compliance of Filing MGT-7 under Section 92(5), Filing MGT-14 under Section 117(2) or Filing of AOC-4 under Section 137(3), Company and OID shall be liable to half of the penalty specified in sections.

Small Company gets enough benefits in regards to Compliance and is indeed a better option to perform the business in an effective manner.

For any queries or requirements contact:

CS Arpit Garg

8447773833