Financial Service Provider –

IBC Rules, 2019

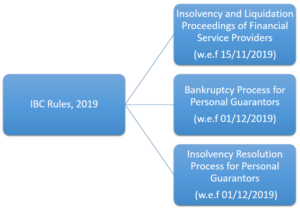

Ministry of Corporate Affairs in its continuous endeavour for making Insolvency and its proceedings more stringent and in line, Ministry of Corporate Affairs have Notified Insolvency and Bankruptcy Rules, 2019.

So let’s analyse 1st Rules i.e. Insolvency and Bankruptcy (Insolvency and Liquidation Proceedings of Financial Service Providers and Application to Adjudicating Authority) Rules, 2019

Applicability: These Rules apply to financial service providers notified by CG.

Definitions:

· Financial Service Provider: – Non-banking finance companies (which include housing finance companies) with asset size of Rs.500 crore or more, as per last audited balance sheet.

· Regulator: – RBI

· Administrator: – Only Administrator proposed by the RBI and appointed as such by the NCLT shall act as an insolvency professional, interim resolution professional, resolution professional or liquidator, as the case may be.

· Advisory Committee: – Regulator may within 45 days of Insolvency Commencement Date form Advisory Committee to advise Administrator in operations of CIRP. Advisory Committee shall consists of 3 or more members and the Administrator shall chair the meeting of the Committee.

CIRP of Financial Service Provider

CIRP of Corporate Debtor Shall as it is apply to IRP of Financial Service Provider subject to modifications:-

1. Application shall be made by a RBI against Financial Service Provider to Initiate CIRP. The application shall be dealt in the same manner as of Financial Creditor under section 7.

2. NCLT shall appoint an Individual as Administrator as proposed by RBI.

3. Application for Insolvency Proceedings shall be filed in Form 1along with:-

(i) Fees of Rs. 25,000/-

(ii) Consent of Proposed Administrator in Form 2

(iii) Other Documents mentioned in Form 1

4. Application shall be filed in electronic form but till the time facility is not available, it shall be filed in USB Flash Drive.

Liquidation Process of Financial Service Provider

Liquidation Process of the corporate debtor shall apply as it is to the liquidation process of a financial service provider subject to modifications: ―

(a) The authorization license or registration shall not be suspended or cancelled during the liquidation process, unless an opportunity of being heard has been provided to the liquidator;

(b) NCLT shall provide RBI an opportunity of being heard before passing an order for liquidation or dissolution of the financial service provider.

Voluntary Liquidation Process of Financial Service Provider

Voluntary Liquidation Process of the corporate debtor shall apply as it is to the voluntary liquidation process of a financial service provider subject to modifications:-

(a) Prior permission of RBI and the same to be included in affidavit.

(c) NCLT shall provide an opportunity of being heard before passing a dissolution order.

For any Queries Please contact:-

CS Arpit Garg

8447773833

arpitgargcs@gmail.com