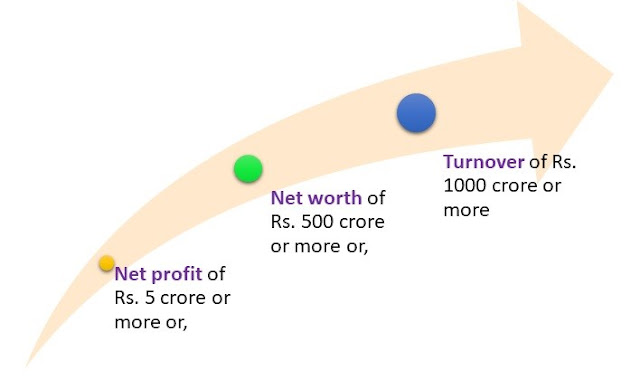

Every Citizen have a duty towards the society for its well-being and development similarly Companies Act, 2013 vide Section 135 makes its mandatory for every company having:-

During immediately preceding FY to constitute a CSR Committee.

Composition of CSR Committee

(Also to be disclosed in the Board Report)

Minimum 3 directors out of which 1 shall be Independent Director.

Duties of CSR Committee

Content of the CSR Policy

Content of the CSR Policy shall be disclosed in the Board Report and shall be placed on the website of the company, if any and shall include the list of CSR projects that company plans to undertake and the monitoring process of such projects.

It is the responsibility of the Board to ensure CSR activities are undertaken by the company.

Expenditure on CSR Activities

Company shall spend in every financial year, a minimum of 2% of its average net profits made during the 3 immediately preceding FY, in pursuance of its CSR Policy.

If the company fails to spend such amount, the Board shall specify the reasons for not spending the amount in the Board Report.

Activities that accounts for CSR Contribution

(As per Schedule VII of Companies Act 2013)

Activities excluding activities undertaken in normal course of business counts for CSR such as:-

Ø Eradicating hunger, poverty and malnutrition, promoting health care and sanitation and making available safe drinking water.

Ø Promoting education and employment enhancing vocation skills.

Ø Promoting gender equality, empowering women, setting up old age homes, day care centres and facilities for senior citizens and measures for reducing inequalities faced by socially and economically backward groups.

Ø Ensuring environmental sustainability.

Ø Protection of national heritage, art and culture.

Ø Measures for the benefit of armed forces veterans, war widows and their dependents.

Ø Training to promote rural sports.

Ø Contribution to the fund set up by the central govt.

Ø Contributions or funds provided to technology incubators located within academic institutions which are approved by the central govt.

Ø Rural development projects.

Ø Slum area development.

Frequently Asked Questions (FAQ’s)

Q1 If the company has made profits in the year 2018-2019, then is there need to comply with the provisions of Section 135?

Answer: Yes, Company have to constitute a CSR Committee in FY 2019-2020.

Q2 If section 135 applicable on any company, then what is the time period for investment on CSR activity?

Answer: No prescribed time period for investment but reporting of the investment on CSR activity has to be made in the Board Report.

Q3 As Independent Director is required in CSR committee. Whether this condition applicable on Private Company also.

Answer: No, In case of Private Limited Companies, CSR Committee may consist of only two Board of Directors.

Q4 Whether the average net profit criteria in section 135 is Net profit before tax or Net profit after tax?

Answer: Computation of Net Profit is as per Section 198 which is primarily Net Profit before Tax.

Q5 Can the CSR expenditure be spent on the activities beyond Schedule VII?

Answer: Yes, Activities mentioned in Schedule VII should be interpreted liberally as they are intended to cover broad and wide range of activities.

Q6 Is Subsidiary Company exempted from complying with the provisions of Section 135 if Holding Company comply with the Section?

Answer: No, as per Rule 3 of CSR Rules, 2014 each and every company which fulfils the criteria specified in Section 135(1) shall constitute a CSR Committee. The criterion needs to be fulfilled individually.

As we can see that CSR is an important step from the point of view of society and environment as a whole which takes in account the corporates to come forward and contribute in the development of the country.

Ready Reference: www.mca.gov.in/Companies Act, 2013

For any queries or suggestions do contact

Like our page on Facebook