As we have seen the closure of this Financial Year in a great hitch because of the pandemic. Although Government has extended some due dates of the compliances but some are yet to be completed in due course and their late fees are not WAIVED.

Today we will discuss about the Annual Compliances of a Limited Liability Partnership. Annual Compliance of a LLP are a combination of ROC and Income Tax.

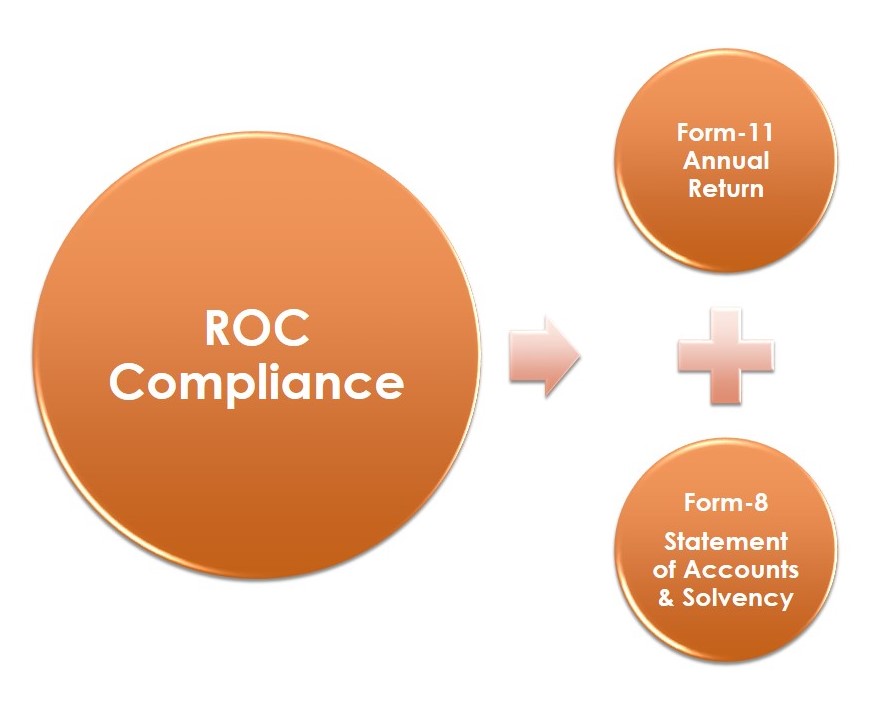

Let’s Discuss with the ROC Compliance First:-

Every LLP is required to file FORM-11 Annual Return within 60 days of closing of Financial Year i.e 30 May and FORM-8 Statement of Accounts and Solvency within 30 days of end of 6 months from closing of FY i.e 30 October.

Form-11- It consist of Annual Return. It contains details of Partners, Designated Partners, Turnover of the LLP, Compounding of Offences etc.It is the mandatory form which has to be filed by the LLP on or before 30 May every year.

Form 8– It consists of Statement of Account & Solvency. It contains the complete financial position of the LLP containing the statement of assets and liabilities and income & expenditure statement. Form-8 shall be filed on or before 30 October every year.

Note:- Audit Requirements for LLP: If turnover of the LLP exceeds ₹ 40 Lakh; or Total contribution of Partners exceeds ₹ 25 Lakh then the financial statements of the LLP shall be audited by a CA.

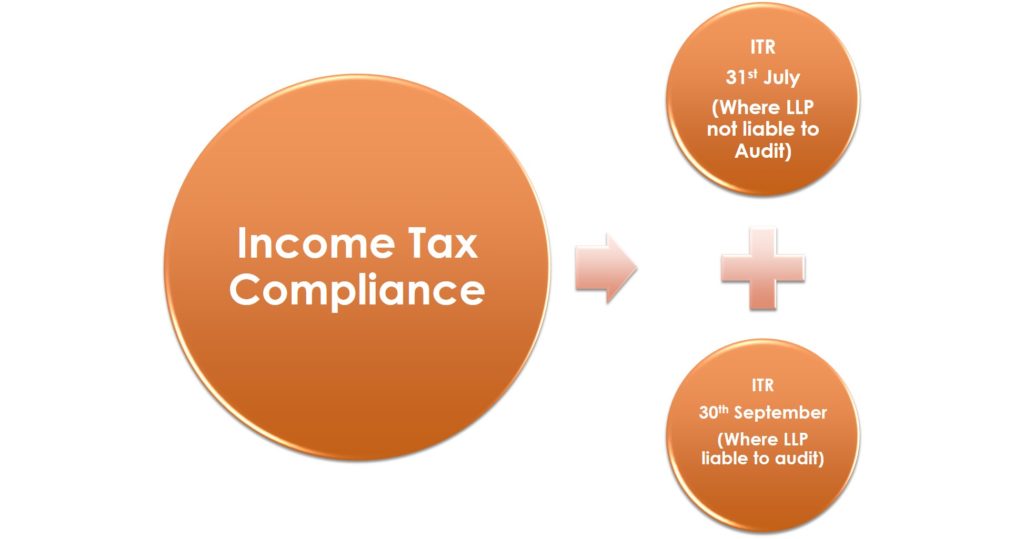

Lets Discuss the Income Tax, 1961 compliance for LLP

Income Tax return are to be filed by the LLP for the Financial Year.

Due Dates are 31st July every year for LLP where LLP are not liable to audit and 30th September where LLP are liable to audit.

Compliance for LLP are minimal and there non-compliance can cost too much for a business.

For any queries or requirements contact

CS Arpit Garg

Practicing Company Secretary & Founder-Compliance Arena

info@compliancearena.in

8447773833