Finance Minister on 13.05.2020 make important announcement on Atmanirbhar Bharat which specifically made provisions for MSME’s making changes in the definition of MSME’s and benefitted them in various ways.

Let’s discuss the 6 various announcement for MSME’s

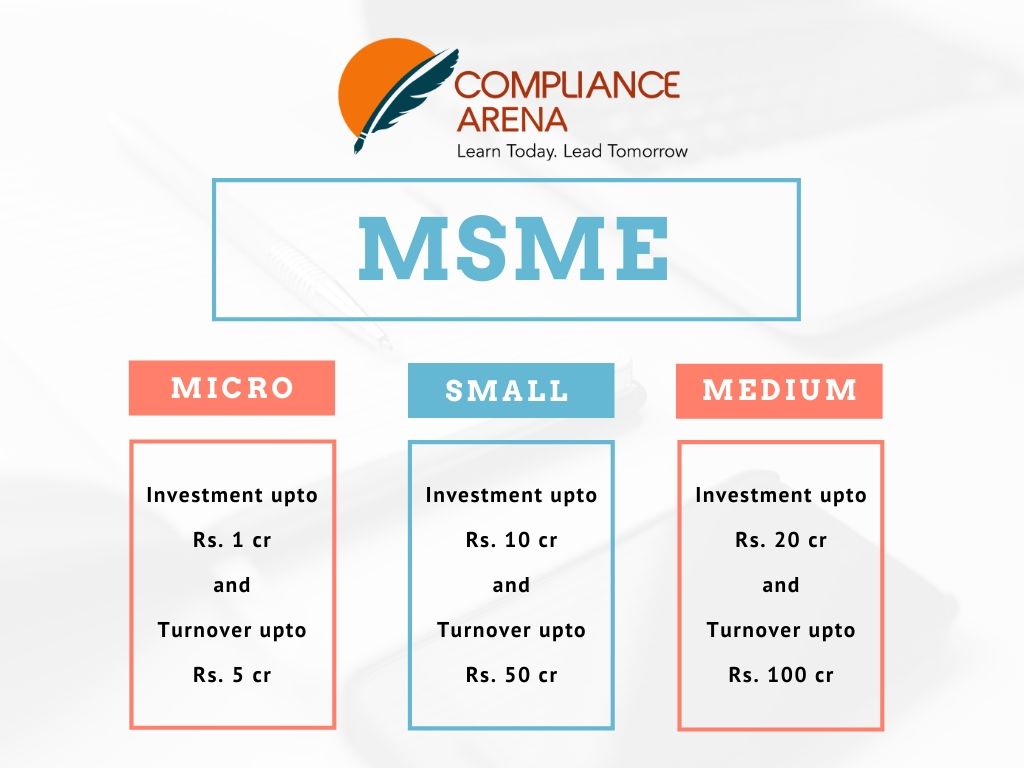

Definition of MSME’s

Now there is no differentiation for Manufacturing and Service Sector like earlier provisions. Also, there is an additional clause of Turnover for getting registration in MSME.

Collateral Free Loan

Banks and NBFCs will offer up to 20% of entire outstanding credit as on February 29, 2020, to MSMEs. Units with upto Rs 25 crore outstanding credit and Rs 100 crore turnover are eligible for taking these loans. These loans will have a 4 year tenor with a moratorium of 12 months on principal payment. The scheme can be availed till October 31, 2020. This loan is available to exisiting MSME’s are eligible to take up collateral free loan.

Subordinate Debt for stressed MSMEs

MSME’s declared NPAs or those stressed will be eligible for equity support as the government will facilitate the provision of Rs 20,000 crore as subordinate debt. Promoters of the MSME will be given debt by banks, which will then be infused by promoter as equity in the Unit

Global tenders disallowed

Global tenders in government sector upto Rs. 200 crore will be disallowed and shall be open to MSME’s. This will boost the MSME’s toward self-reliant India and will support Make in India Campaign.

Clearing MSME Dues

MSME receivables from Gov and CPSEs to be released in 45 days

Rs 50,000 crore equity infusion

Govt. will infuse Rs. 50,000 crore in Equity through Fund of Fund operated through Mother-Daughter Fund. This will provide equity funding for MSMEs with growth potential and viability.

India will see a boost in the economy by the various judgement and announcement which benefit to the MSME and their businesses. Let’s wait for more announcement from our Honorable Finance Minister towards Atmanirbhar Bharat.

For further queries contact

CS Arpit Garg

Practicing Company Secretary & Founder Compliance Arena

info@compliancearena.in

8447773833