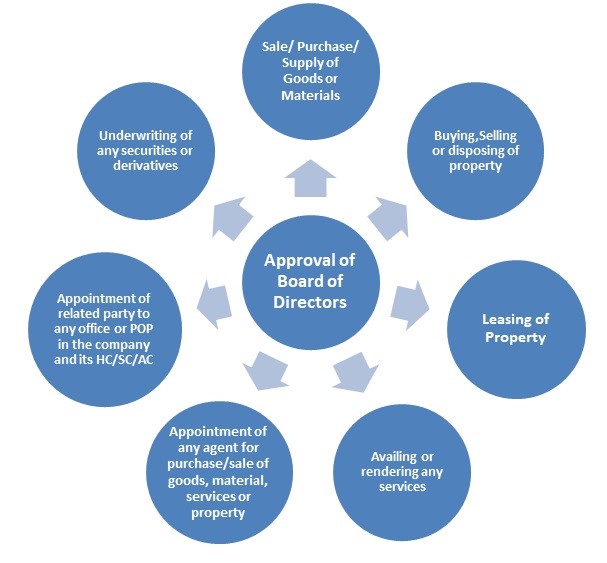

Related Party Transaction means a transaction entered by two or more related party. Related Party is defined under section 2(76) of Companies Act, 2013. Every RPT’s shall require Board Approval except in certain cases. There are total 7 transactions on which Section 188 applies. The figure below shows all the transactions.

If any transaction exceeds the limits prescribed below then Shareholder Approval is required. Ordinary Resolution shall be passed in below cases:-

Nature of Transaction | Limit |

Sale, purchase or supply of any goods or materials directly or through appointment of agents | Exceeding 10% of the turnover or Rs.100 crore whichever is lower |

Selling or otherwise disposing of, or buying, property directly or through appointment of agents | Exceeding 10% of net worth or Rs.100 crore whichever is lower |

Leasing of property | Exceeding 10% of the net worth or exceeding 10% of turnover or Rs.100 crore whichever is lower |

Availing or rendering of any services directly or through appointment of agents | Exceeding 10% of the turnover or Rs. 50 crore whichever is lower |

Appointment to any office or place of profit in the Company, its subsidiary company or associate company | At a monthly remuneration exceeding Rs. 2,50,000/- |

Remuneration for underwriting. | Exceeding 1% of the net worth |

Points to Remember

1. Related Party shall not vote on RPT Transaction if member. (Shall not apply if 90% of the members are related to promoters or are related parties).

2. No Board Approval if in ordinary course of business.

3. No Ordinary Resolution if transaction entered into Holding Co. and its WOS whose accounts are consolidated.

4. All RPT’s are required to be mentioned in Board Report with justification.

Penalty for defaulting Director or employee in:-

i. Listed Co.- Imprisonment – Max 1year.

Fine – Rs. 25000 to Rs. 5 Lakh

Or both

ii. Any Other Company:- Fine Rs. 25000 to Rs 5 lakh.

Register of RPT to be maintained as per format in MBP-4.